Necessity of Dev Tools

Many companies that develop code today have uncovered that the software industry is sometimes tricky. The world needs more software, but it’s not as simple as hiring more developers. Senior programmers are costly and can’t be found easily. Serial dependencies together with uncertain complexity lead to many underestimates of timeline and budget, which in turn lead to bad business outcomes and potential crises.

To facilitate the software development process - many companies are building and adopting developer tools. It’s not that just Google, Microsoft, and Amazon create auxiliary software today. To meet this obvious need, a growing new industry of dev tools vendors has appeared in recent years. Companies like GitHub, GitLab, and HashiCorp are now well-known and the importance of the field has been recognized.

It’s difficult to estimate how quickly the dev tools market has grown in the past decade. Although dev tools are very valuable, most of them are single player tools that didn’t attract investors. Sometimes – they are internal tools built for the specific needs of a particular big tech company (e.g., Google Code Search) or open-source projects that no one paid for.

Players on the Dev-tools market

There are three main vendor groups that work on developer tools today:

1. Large Software Corporations

The first group consists of those large software corporations that build internal tools. They offer competitive pay and better working environment to their developers and can afford to build their own dev tools.

These tools can be later offered to other companies or made open-source, but it may be difficult to get the necessary approvals to do so. The drawback is that the tool may remain internal forever, and even if it goes to the market – the developers won’t have direct compensation if the tool becomes widely used.

2. Open Source Teams

The second group is teams that build open-source dev tools. The developers will receive recognition for their work and the product will be widely used (free version), but it may fail to become commercially successful.

Many of the most widely used developer tools - Git, Emacs, Vim, etc. are open-source projects, but developers have other primary sources of income (working at a large tech company).

GitHub has sponsors, but not many open-source creators will ever find ongoing sponsors. The number of hours developers spend on open source will be constrained by how much income they make.

3. Specialized Dev Tools Companies

The third group is specialized dev tools companies. Most of them are startups, because of the recent rapid growth in market size for dev tools. Dev tools companies have inherent advantages: the users, the customers, and even engineering teammates can be the same people.

If the inner people are happy with the tool, the tool will find its way to the broader market. Dev tools startups can also bring financial benefits, such as offering the employees an equity stake in the business. There is an opinion that dev tools companies will someday exceed the combined value of the most valuable tech companies today.

Dev tools Segments and Categories

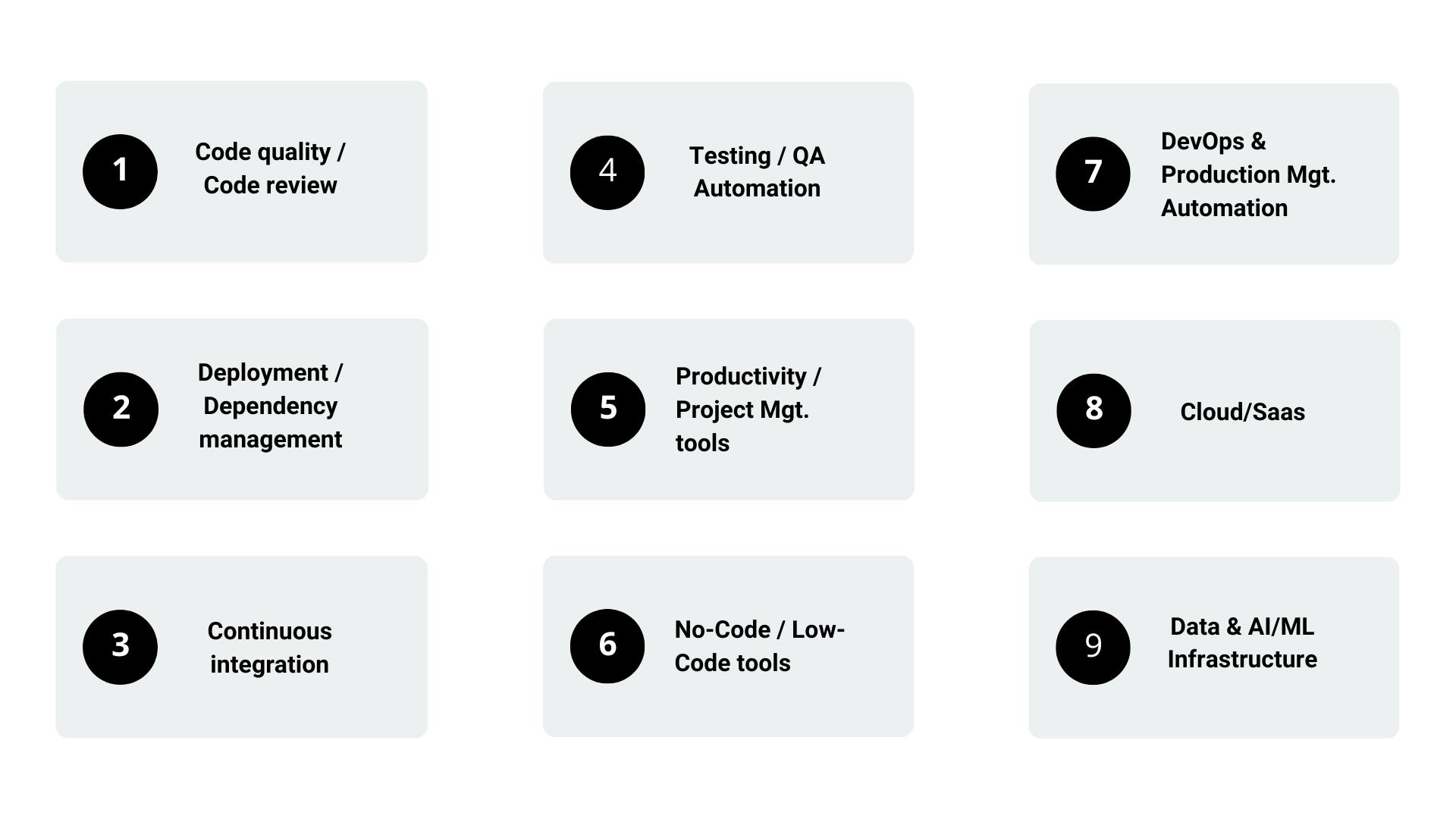

On this basis of purpose and functionality, the dev tools can be categorized into nine segments:

Code quality / Code review – Tools that analyze the code for correctness, reliability, security, and maintainability (for all programming languages, and all the projects in the repository). Examples: CodeCov, CodeClimate, Codacy, Crucible, SonarCloud, SonarQube.

Deployment / Dependency management – Tools that are used to pull all the dependency information into a common POM file, simplifying the references in the child POM file. Examples: Xanu, Depfu, Navisite, Shipa.io.

Continuous integration – Tools that are used to merge all developers' working files to a shared environment several times a day. Examples: CircleCI, FlyCode, LaunchDarkly, Automate.io, Azure pipelines, GradientCI, Emerge Tools.

Testing / QA Automation — Tools that assist the QA team in automating repetitive tasks and running test cases numerous times (scaled tests for the code). Examples: Rookout, AppliTools, Percy, Autify, Jmeter, Postman, Insomnia.

Productivity / Project Management tools - Those tools that help in transforming the gathered data from dev tools like Git and Jira into actionable insights. Examples: Github Copilot, Linear, Swimm.

No-Code / Low-Code tools - Environments for visual development where programmers can connect application components (whether conceptual or visual) by dragging and dropping them and generate new codebases. Examples: Webflow, FlyCode, Google AppSheet, Quickbase, SquareSpace, Adalo, Table2Site.

DevOps & Production Management Automation - Tools that help to improve task performance and advance processes between operations and development with minimal human assistance. Examples: Kubernetes/Docker, Jfrog, Zapier, Integromat, Ansible, Terraform.

Cloud/Saas - Tools that help in accelerating the Cloud development, by using microservices and serverless applications providing developers the freedom to deal easily with complex infrastructure configuration with no scripting. Examples: Navisite, Altostra, Lumigo.

Data & AI/ML Infrastructure - Products and services that help decrease costs and the time it takes to get insights, from quicker processing (run-time) to creating more data flows quickly (design-time). Examples: Snowflake, Upsolver, Acumen.io.

The Perspectives of the Dev tools

In today’s fast digital environment – it seems that dev tools can connect businesses and developers together. In the past developers were engineers, then they became integrators, in the future they will become operators. There is no limit to their capabilities – App Development, Software and Website Management, Dev-Ops Operations, Data Organization, etc.

The features of a successful dev tool include:

Bottom-up Go-to-market: Community-oriented mindset will drive dev-tool adoption. Helping the business users to customize the tool and make their scenarios - will drive the sales.

Enterprise-ready – In order to be sold to business users dev-tool must be safe and secure, with proper SLA and customer support.

Sales Channels – For small clients – the tool should be self-serving, with customer focus; For large enterprises – integration with large providers and cloud vendors is essential.

Clear Value – Visibility is essential; showing the value to stakeholders in real time will increase the engagement and the usage of the tool in the organizations.

The data show that since 2012 most of the capital in the dev-tools space went to investments in data infrastructure and DevOps/production tools, but starting in 2015 there is a slow increase in NCLC (no-code/ low-code) companies funding. The years 2019–2020 show investments are trending towards NC/LC, QA automation, and productivity tools. Venture Capital perception for small companies is often driven by enterprises and Fortune 500 companies adapting a space. Today, 40% of the companies listed in the S&P-500 already use NC/LC platforms.

In the past few years, a lot of developer tools have appeared on the market. Software development has now infiltrated every sector of the economy; even non-tech companies today employ hundreds of programmers working on large codebases. Thus, there is a bright perspective for the dev tools builders.